- Home

- Governance

- Corporate Governance Report

Corporate

Governance Report

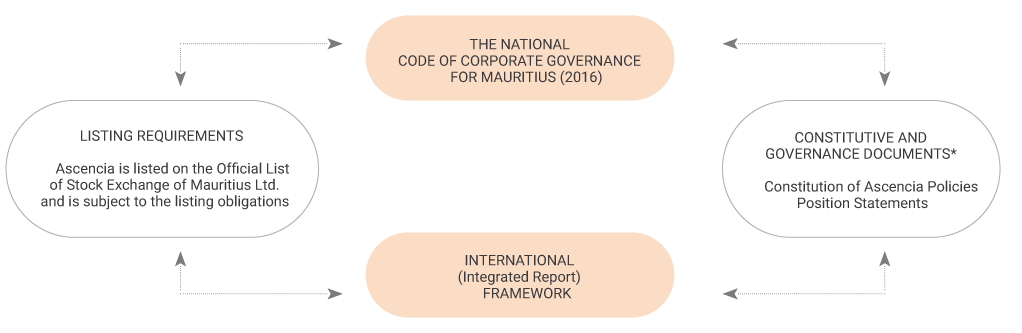

Ascencia Limited (‘Ascencia’ or the ‘Company’) is presently listed on the Official List of The Stock Exchange of Mauritius Ltd (SEM). The Company is also a public interest entity and is required to apply the eight principles of The National Code of Corporate Governance for Mauritius (2016) (the ‘Code’).

The timing of this Corporate Governance report coincides with the ongoing COVID-19 pandemic and you will have read in the leadership review report about the actions taken by the Company to withstand this crisis.

The Board’s collective values, experience and diversity have been crucial during these challenging times to guide the business through the crisis and beyond. Recognising the scale of the impact of COVID-19 and the ongoing significant levels of uncertainty, the Board had examined the fundamentals of the way Ascencia operates, challenged its assumptions and tested its beliefs, to find its optimum structure for the long term.

This year, besides it’s normal agenda, the Board focused on the following key matters:

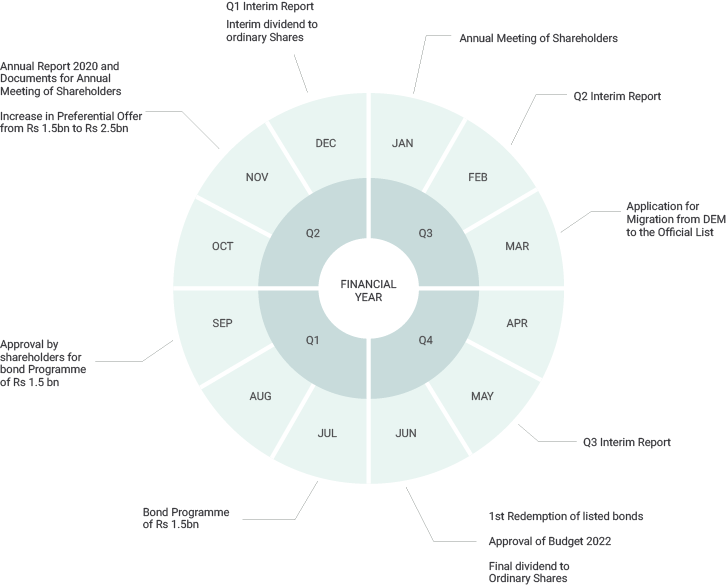

- the approval of the Bond Programme amounting in total to Rs 2.5 bn;

- the migration of Ascencia to the Official List of The Stock Exchange of Mauritius Ltd

- the acceleration of the Company’s progress on its sustainability commitments through LEED certification for its malls, starting with Phoenix Mall as a pilot project; and

- the introduction of Ascencia on the SEM Sustainability Index.

1. Corporate Governance Framework

*Disclosures under Principle 1 of the Code and available on www.ascenciamalls.com

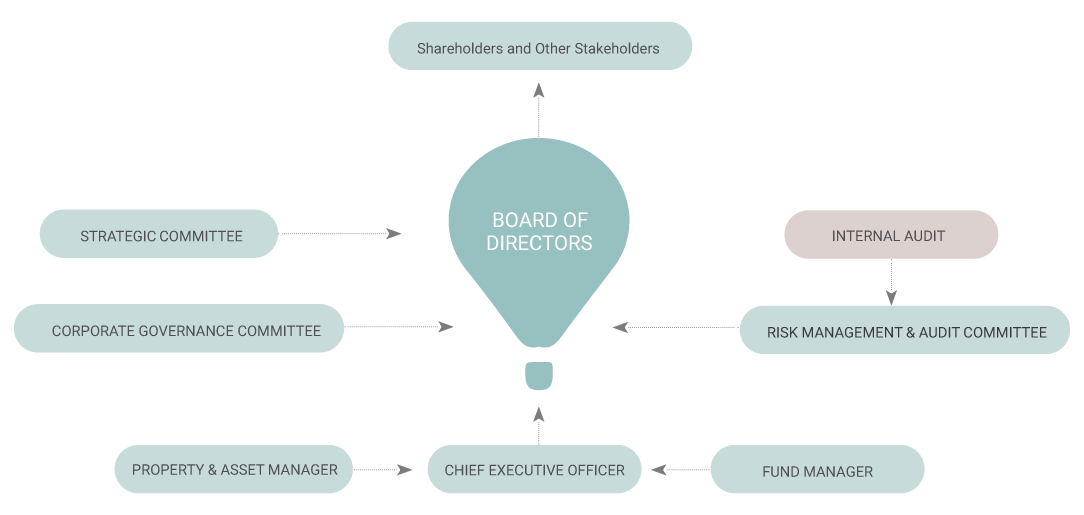

2. Governance Structure

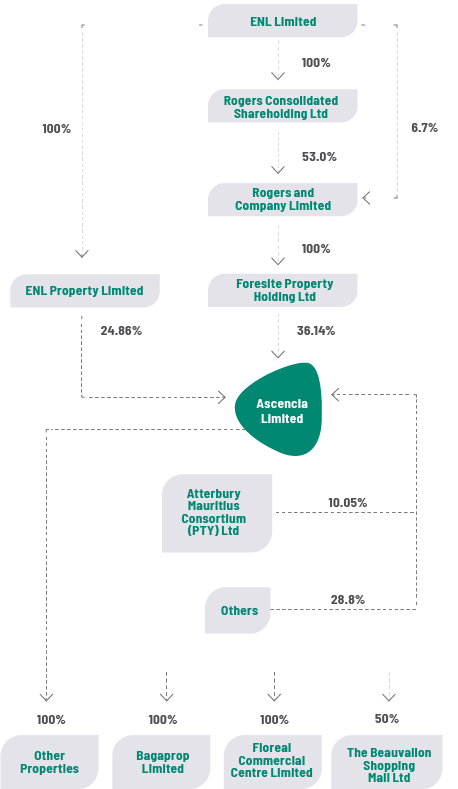

Foresite Property Holding Ltd and ENL Property Ltd together hold 61% of the shareholding and voting rights of Ascencia. Further to an agreement between Foresite Property Holding Ltd and ENL Property Ltd;

- at least half of the Board is nominated for appointment by Rogers;

- the Chairman of the Board is also chosen from the representative directors of Rogers; and

- for all shareholder matters concerning Ascencia, ENL Property Ltd shall vote in the same manner as Foresite Property Holding Ltd.

The Board of Ascencia assumes responsibility for leading and controlling the organisation and meeting all legal and regulatory requirements.

As at 30 June 2021, Ascencia is headed by a unitary Board comprising of 12 directors, under the chairmanship of Mr. Philippe Espitalier-Noël, a non-executive director. The composition of the Board and the category of directors are set out on page 68 of the Annual Report. Furthermore, as at 30 June 2021, there were two Executive Directors, four Non-Executive Directors (‘NED’) and five Independent Non-Executive Directors (‘INED’). As from 13 July 2021, the directorship status of Mr. Dominique Galea switched from INED to NED since he has served for more than nine continuous years from the date of his first appointment to the Board of the company. The Company presently has no employee. It has retained the services of Rogers and Company Limited (‘Rogers’) as Fund Manager and EnAtt Ltd, as Property and Asset Manager of the Company.

On 15 December 2020, Mrs. Belinda Vacher replaced Mr. Damien Mamet to fulfil the role of the representative of the Fund Manager of the Company. The Chief Executive Officer of the Company, namely Mr. Frederic Tyack, although not employed by the Company, has executive responsibilities since he oversees the day-to-day management of Ascencia. The function and role of the Chairman and that of the Chief Executive Officer are separate.

Cognitive diversity is important for good decision making, and the Nomination Committee pays particular attention to this consideration in its annual review of the Board composition and succession planning. Diversity is a key consideration in considering potential INED candidates. The nomination process and appointment of directors is posted on: www.ascenciamalls.com.

During the year under review and upon the recommendation of the Nomination Committee, the Board approved the appointment of Mr. Bojrazsingh Boyramboli to fill a casual vacancy left by Mr. Ashis Kumar Hoolas.

At the time of approving this report and upon the recommendation of the Nomination Committee, the Board approved the appointment of Dr Dhanandjay Kawol to fill a casual vacancy left by Mr. Bojrazsingh Boyramboli.

A directors’ and officers’ liability insurance policy has been subscribed to and renewed by Ascencia. The policy provides cover for the risks arising out of the acts or omissions of the Directors and Officers of Ascencia. The cover does not provide insurance against fraudulent, malicious or wilful acts or omissions.

Upon appointment to the Board and/or its committees, new directors receive a letter of appointment as well as a comprehensive induction pack explaining:

• Background information about the Company

• Role and responsibilities of a director

• Attributes of an effective Board

• Calendar of Board and Committee meetings

• Governance documents, policies and procedures

• Committees’ terms of reference

• Share dealing Code

Director's Induction - Mr. Shreekantsingh (Antish) Bissessur's comment

"My induction has been well tailored and professionally organised. It has enabled me to quickly develop my knowledge of all the relevant parts of the business of Ascencia."

Secretary's comment

"The Director’s induction was tailored to his role as a non-executive Director of a public limited company, listed on the Stock Exchange of Mauritius Ltd. The programme was designed to cover all regulatory and compliance aspects, in addition to ensuring the Director gained sufficient knowledge and understanding of the business to effectively participate in the Board discussions and oversight of the Company."

|

The induction programme and orientation process is supervised by the CEO and the Secretary of Ascencia. All Directors have access to the Secretary and to the CEO or the Fund Manager to discuss issues or to obtain information on specific areas or items to be considered. Furthermore, the Directors have access to the records of the Company and they have the right to request independent professional advice at the expense of the Company. The Board and its Committees also have the authority to secure the attendance at meetings of third parties with relevant experience and expertise as and when required, at the expense of the Company.

|

The Board believes that continuous director training and development supports board effectiveness. On 12 and 16 November 2020 respectively, two training workshops on the changes brought about to the Workers Rights’ Act 2019 and Anti-Money Laundering and Countering the Financing of Terrorism were organised for the directors of Ascencia. The workshops were facilitated by Jurisconsult Chambers.

The Board is assisted in the discharge of its duties by three Board Committees, namely the Corporate Governance Committee (the ‘CGC’) (acting also as Nomination Committee and Remuneration Committee), the Risk Management and Audit Committee (‘RMAC’) and the Strategic Committee (‘SC’).

The membership and terms of references of the CGC, RMAC and SC are available at https://www.ascenciamalls.com/boardcommittees.

On 23 September, 24 September and 27 September 2021, the CGC, RMAC and SC reviewed their terms of reference and noted that they had met their objectives.

9. Board and Committees meetings & Remuneration

The composition and attendance of Board Committee meetings and meetings of Shareholders and Bondholders as well as the remuneration and benefits paid to the Directors of the Company for the financial year ended 30 June 2021 are set out in Table 1.

| Table 1 | ||||||||

|---|---|---|---|---|---|---|---|---|

| Category | Board | Corporate Governance Committee ('CGC') |

Risk Management & Audit Committee ("RMAC') |

Strategic Committee ('SC') |

Annual Meeting of Shareholders |

Special Meeting of Shareholders |

Remuneration & Benefits (Rs) |

|

| ESPITALIER-NOËL, Philippe (Chairman of the Board and Acting Chairman of SC) |

NED | 6/6 | 4/4 | - | 1/1 | 1/1 | 1/1 | - |

| GALEA, Dominique (Chairman of CGC) |

INED | 6/6 | 4/4 | - | - | 1/1 | 1/1 | 389,657 |

| TYACK, Frederic | ED | 6/6 | - | - | 1/1 | 1/1 | 1/1 | - |

| ESPITALIER-NOËL, Hector |

NED | 4/6 | - | - | 1/1 | 0/1 | 0/1 | - |

| VEERASAMY, Naderasen Pillay |

INED | 5/6 | 3/4 | - | - | 1/1 | 0/1 | 292,242 |

| MAMET, Damien | NED | 5/6 | - | 5/5 | - | 1/1 | 1/1 | - |

| LAM KIN TENG, Dean (Chairman of RMAC) |

INED | 6/6 | - | 5/5 | - | 1/1 | 0/1 | 372,466 |

| PASCAL, Pierre-Yves |

INED | 5/6 | 3/4 | 5/5 | - | 1/1 | 1/1 | 378,196 |

| BOSHOFF Armond |

NED | 6/6 | - | - | - | 0/1 | 1/1 | 257,861 |

| VACHER Belinda* | ED | 6/6 | - | 2/2 | 1/1 | 1/1 | 1/1 | - |

| AH CHING, Cheong Shaow Woo** |

NED | 1/1 | - | 1/2 | - | 0/0 | 0/1 | - |

| HOOLASS, Ashis Kumar*** |

INED | 1/2 | - | - | - | 0/1 | 0/1 | 101,213 |

| BISSESSUR Shreekantsingh**** |

NED | 5/5 | - | - | - | 1/1 | - | - |

| BOYRAMBOLI, Bojrazsingh***** |

INED | 1/3 | - | - | - | - | - | 70,694 |

INED: Independent Non-Executive Director

NED: Non-Executive Director

ED: Executive Director

NB

(1): The INED satisfy the independence criteria tests of Principle 2 of the Code.

(2): The size of the Board is in line with S14.2 of the Constitution of the Company.

*Appointed as RMAC member on 10 December 2020 **Resigned on 12 November 2020 ***Resigned on 8 February 2021

****Appointed on 12 November 2020 *****Appointed on 9 February 2021

As a general principle, Directors employed by Rogers and ENL Groups are not remunerated any Directors’ fees. The remuneration of Independent Non-Executive Directors and Non-Executive Directors (which was last reviewed in May 2021) is composed of a basic monthly fee and an attendance fee. The Chairmen of the Board Committees are paid a higher fee. For the year under review, the directors of the subsidiaries of Ascencia did not perceive any fee for serving on their respective Boards.

10. Board matters looked into for the financial year ended 30 June 2021

11. Engagement with Stakeholders

The shareholding structure of Ascencia as at 30 June 2021 is set out below.

| Stakeholders | How we engage | Key Topics of engagement |

|---|---|---|

| Our people Employees forming part of the Property, Asset and Fund Management teams |

|

|

| Tenants |

|

|

| Government Policy and regulatory changes affect our businesses and create the framework through which we operate. Working closely with local authorities enables us to contribute our private sector experience and expertise to the publicagenda and produce better policy outcomes and service delivery |

|

|

| Shoppers |

|

|

| Shareholders |

|

|

12. Other Mandatory Disclosures

12.1 Dealings in the securities by Director

12.2 Related Party Transactions

12.3 Conflict of interests and interest registers

The Secretary maintains a conflict of interests register. Any instances where directors are conflicted are noted down by the Secretary.

Furthermore, the Constitution of the Company provides that a director who is interested in a transaction entered into, or to be entered into, by the

Company may not vote on any matter relating to that transaction.

The Secretary also maintains an interest register which is available for consultation by shareholders, upon written request to the Secretary.

12.4 Board and Individual Evaluation

A Board evaluation survey was carried out in the financial year 2020. The findings thereof were imparted in last year’s report. The action points

implemented are set out below:

| Evaluation Findings | Status |

|---|---|

| Continuous development of Directors |

Two training workshops on the changes brought about to the Workers Rights’ Act 2019 and Anti-Money Laundering and Countering the Financing of Terrorism were organised duringthe year under review. |

| Directors requested that update on activities of the malls be communicated. | Monthly newsletter on the activities of the malls are circulated to Directors. |

As the COVID-19 pandemic impacted the business operations of the Company, it was agreed to defer the individual director evaluation.

13. Other Matters

13.1 Corporate and Social Responsibilities

The Company did not make any political donation for the year under review. Please refer to the Social Capital section for more details.

13.2 Environmental Responsibilities

Please refer to the Natural Capital section for more details.

13.3 Financial Responsibilities

Please refer to the Financial Capital section for more details.