Company Overview

Staying singularly focused

- Home

- Company overview

Our Journey

Upwards

OUR STRATEGY TO ACQUIRE, RENOVATE AND CONSTANTLY IMPROVE OUR ASSETS IS PAYING OFF. "

The creation of Ascencia in 2007 has shaped the retail industry by providing authentic and singular experiences within its seven malls. Ascencia has geared-up to meet these needs positioning itself as a true leader in the commercial real-estate sector on the island. Our strategy to acquire, renovate and constantly improve our assets has paid off.

By doing so, Ascencia has pioneered a new Asset class locally that provides sustainable value through cash yield and capital appreciation.

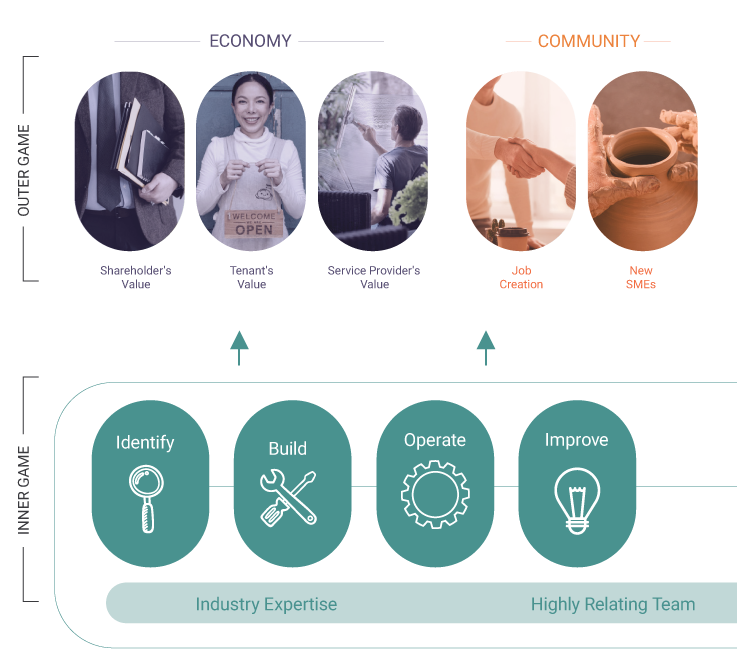

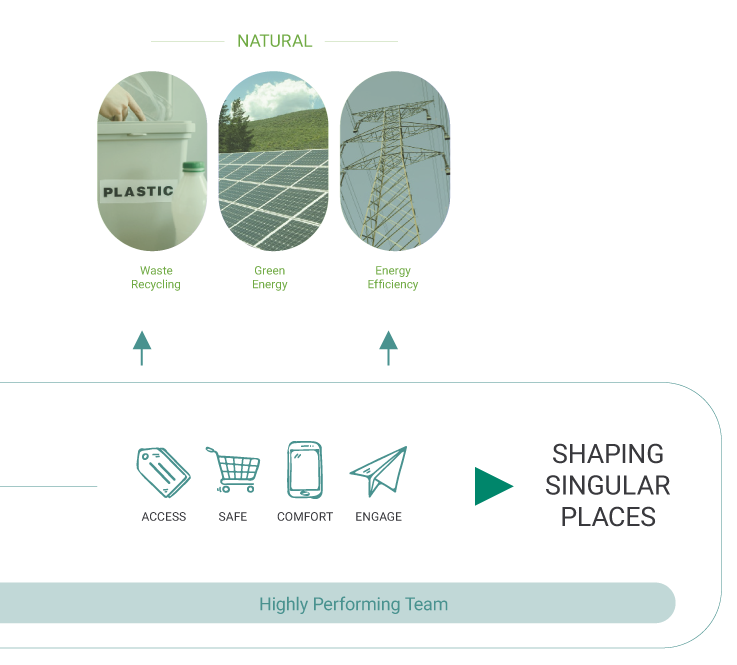

Today, Ascencia is the leading retail property company in Mauritius listed on the Official Market of the Stock Exchange of Mauritius. The Company’s vision is to create shopping and entertainment areas based on its customer promise: “Shaping Singular Places’’. This vision has governed the creation of seven shopping malls, each with its own identity and inspired by the history and authentic culture of Mauritius.

The malls are namely Bagatelle Mall, Phoenix Mall, Riche-Terre Mall, Bo’valon Mall, Kendra, Les Allées and So'flo.

As at 30 June 2021, the Group’s Investment property value and the market capitalisation stood at Rs 13.8bn and Rs 14.7bn respectively.

-

Incorporation of the Company on 28th June 2007 with an initial started capital of

Rs 441m.

-

Listing on DEM and capital raising

Rs 308m.

Acquisition of Phoenix Mall, Riche Terre and 3 smaller retail properties operating under the brand "Spar". Listing of the Ordinary Shares of the Company on the DEM of the SEM on 23rd December.

-

Capital raising of

Rs 320m.

First phase extension of Phoenix Mall.

-

Capital raising of

Rs 1.5bn.

Acquisition of an initial 50.1% stake in Bagatelle Mall, 100% stake in Kendra & Les Allées.

-

Capital raising of

Rs 450m.

Renovation of Riche Terre Mall and completion of the extension of Phoenix Mall.

-

Capital raising of

Rs 1.1bn.

Acquisition of Gardens of Bagatelle Office park and 34.9% of Bagatelle Mall.

-

Investment and launch of the Home & Leisure node at Bagatelle Mall.

-

Development and launch of So’flo and redevelopment of Phoenix Mall. Sale of non-core assets for

Rs 484m.

-

Development and launch of Bo’Valon Mall.

-

Extension of Bagatelle Mall which includes a new section and the Decathlon box. CARE MAU A+ (stable) Rating on all the debt instruments of the Company (including bonds). Successful bond raising of

Rs 1.5bn

by the way of a private placement.

-

Agreement between MEL and Ascencia about the integration of a metro station in Phoenix Mall.

Listing on the Official List of SEM. Inclusion of Ascencia in the sustainability index, SEMSI.

Key

Highlights

Rent to Turnover (%)

Profit from Operations (Rs m)

NAVPS (Rs)

Vacancy (%)

Investment Property Portfolio (Rs bn)

DPS (Rs)